As a Denver native, and although I reside now in Oregon, I keep tabs on anything / everything in Colorado. For instance, my immediate family all live there. I’m the lone wolf here in the Pacific Northwest. I’m interested in Russell Wilson’s new mansion in a suburb of Denver (sorry, Sea Chicken fans). I’ve been playing tour guide for my neighbors, who are moving to Pagosa Springs, CO next month. I’ve been playing tour guide for them from afar.

So what does this have to do with what’s happening in the real estate market locally, you ask? Well, perhaps a lot.

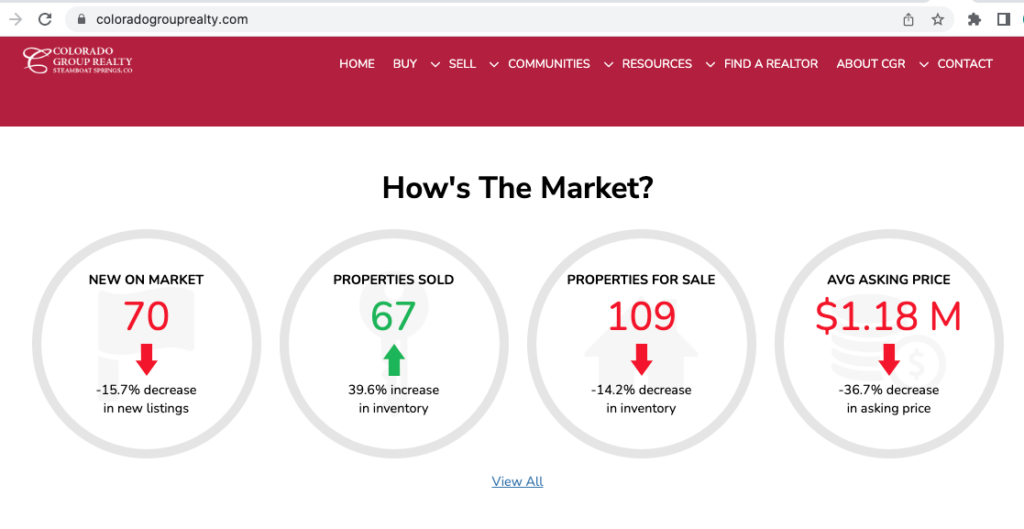

I saw some interesting market statistics about Steamboat Springs, CO on one of its local real estate brokerage firm’s websites.

If you do not know Steamboat Springs, well it’s a destination ski area (off the traffic-laden I-70 corridor from Denver to Loveland Basin, Copper Mountain, and Vail), offering smalltown charm, a great ski mountain with all the modern amenities, and four seasons. Yes, including ~250 days of sun, despite low temperatures and storms throughout the winter months.

‘So why are you sharing market data on a mountain town whose real estate is for mostly second home buyers?’ Well, there may be some interesting trends occurring there, and more parallels to what all markets are to do in future months than you realize. For example:

- The pandemic has had buyers seek out locations outside of metro areas, for better work environs, perhaps standards of living, and places to raise families in areas less traveled. (But you better bring your cash… There are only 11 single family homes under $2M throughout Routt County!)

- Like most metro communities, it’s been a relative zero-sum gain in inventory, whereby new listings equal new sales activity.

- Average days-on-market is 7 days, which still works to the seller’s advantage.

In addition to the above and anecdotally, I’ve learned most sales in the greater Steamboat Springs community are cash transactions, whereby buyers are not affected by, nor reliant on, rising interest rates. Year-on-year, interest rates are now 1.5% higher, which means those buyers that must rely on financial institution loans, face a ~20% increase in its monthly mortgage payment. The Federal Reserve has hinted (strongly) that more rate increases are forthcoming, which will only exacerbate this gap further.

Thus, cash is truly king. Higher rates will eventually curb demand, inventory will grow, but will favor those that have cash to purchase properties. Less competition on bids will allow buyers to be rewarded with a home they want, not what the market dictates they buy due to scarcity. So if you have cash, it’s best now to use it or lose it, so to speak.

On a final note, and if you haven’t skied Steamboat’s mountain, put it on your bucket list…immediately.